CONSUMERDUTY.COM

Measuring Customer Outcomes

Meeting the FCA’s Expectations for measuring customer outcomes under Consumer Duty.

The Financial Conduct Authority (FCA) requires financial services firms to deliver measurable and documented customer outcomes that align with the Four Outcomes of Consumer Duty.

This isn’t about generic KPIs; it’s about having clear, actionable data that shows how well you’re delivering customer outcomes:

Customer Outcome Evidence – Demonstrating actual customer outcomes, not just experience or satisfaction scores.

Benchmarked Data – Showing how firms compare with each other in their subsector and across financial services.

Closed-Loop System – Identifying issues on an individual and systemic basis, ensuring the right customer outcome and insight led improvement.

What you get:

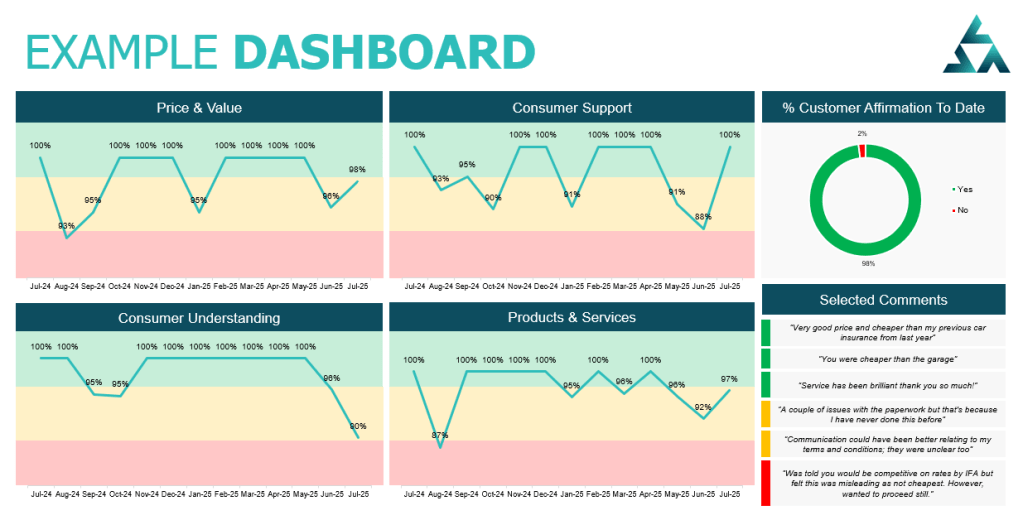

Dashboards bespoke to each of the firms we work with, downloadable through our platform the Feedback Hub.

Verbatim analysis versus the Four Outcomes with monthly sessions to feedback findings and recommendations.

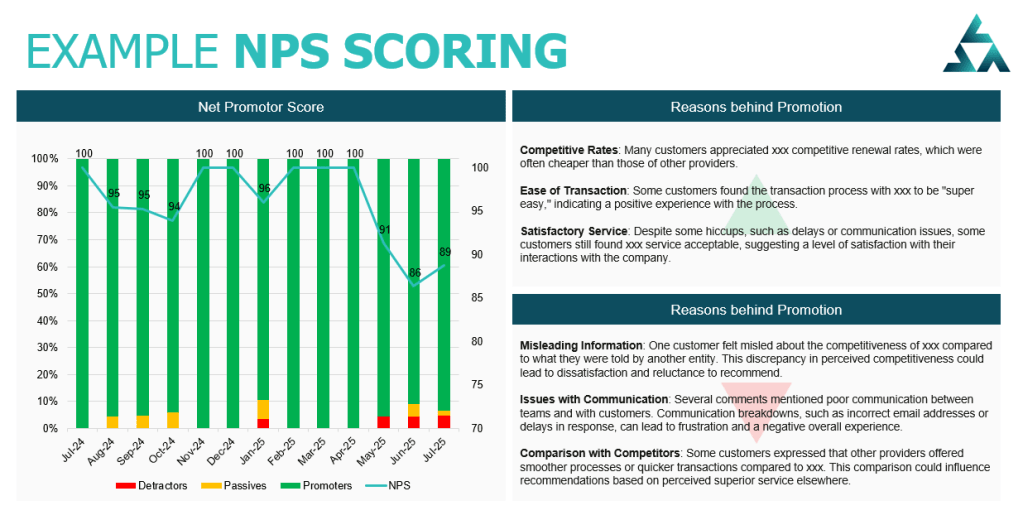

Net Promoter Scoring (NPS) included as standard in all engagements, with analysis to understand drivers behind promotion and detraction.

Are Traditional Metrics Giving You the Full Picture?

Traditional metrics can indicate satisfaction, loyalty, or operational efficiency but fall short in evaluating whether products and services genuinely deliver good outcomes.

Complaints

Complaint numbers don’t indicate if outcomes are fair or beneficial, and could mean issues are unnoticed or unresolved.

Customer Satisfaction (CSAT)

CSAT reflects satisfaction at single touchpoints, not overall product suitability or long-term value.

Customer Retention Rate

Retention may suggest loyalty but could stem from limited alternatives, not genuine satisfaction with outcomes.

First-Call Resolution (FCR)

FCR shows efficiency but not whether the resolution supports fair, beneficial outcomes for customers.

Market Share

Suggests popularity but does not account for whether customers are provide good outcomes for all segments.

Repeat Purchase Rate

Repeat buys might indicate popularity, not necessarily fair value or alignment with customer needs.

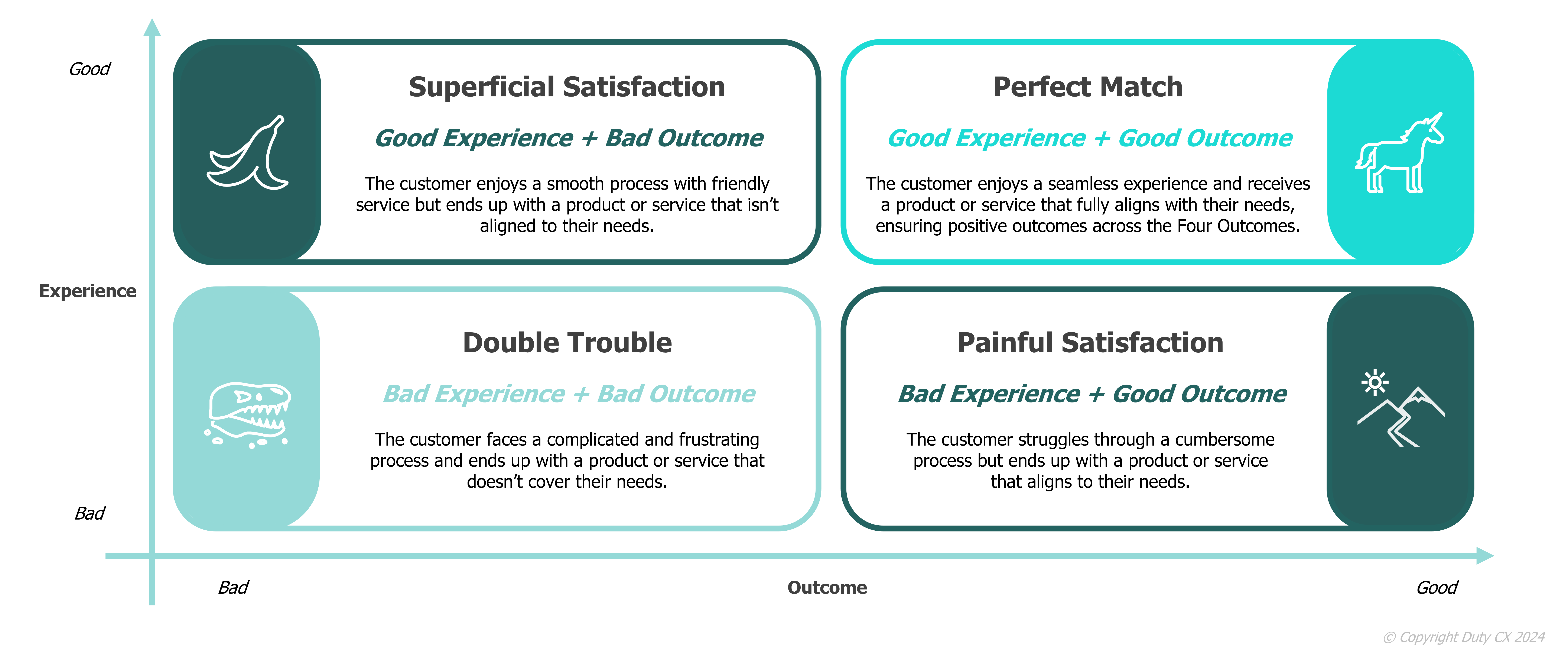

Customer Experience vs.

Customer Outcomes

Customer experience (CX) metrics provide a sense of general satisfaction, but they don’t reveal whether your firm is delivering good outcomes. Our Consumer Duty outcome measures go deeper, tracking customer outcomes in real time, benchmarking performance, and providing qualitative insights to drive meaningful, customer-led change.

Sheldon Mills, executive director of consumers and competition at the FCA:

“Be in no doubt: the Duty will be a significant shift in what we expect of firms. It means making lasting changes to culture and behaviour to consistently deliver good outcomes”

Leading experts in Consumer Duty & Customer Outcome Measurement

Charlie Williams

Managing Director

Customer Outcome & Experience Measurement Leader

A veteran of financial services and a co-founder of Investor in Customers, Charlie knows what ‘good’ looks like in customer outcomes.

His expertise in customer outcome measurement and Consumer Duty compliance helps firms benchmark, monitor, and improve their performance, setting the standard for compliance and customer experience.

Nisha Arora, FCA Director of Cross Cutting Policy & Strategy:

“I would stress that firms who haven’t considered how they will monitor outcomes for different groups of consumers, including those in vulnerable circumstances, will need to do more to meet our expectations”

What our clients say:

Joseph Hall

Head of Customer & Conduct Risk

“The whole process has been seamless, with Charlie & James taking responsibility for the communication and gathering of responses. Whilst these surveys focused explicitly on the four outcomes, this also provided valuable insight into our vulnerable customer population and also a view on the overall product lifecycle”

Sheriden Davy

Chief Risk Officer

“This feedback is invaluable to us in being able to confidently attest that we are complying with the FCA’s Consumer duty requirements, but more importantly in giving us greater assurance that our customers understand what we are doing with them, why we are doing it and how it will hopefully derive good outcomes for them”

Julie Warren

Marketing Director

“We have been working with James & Charlie for around a year now and are super impressed with the outcomes of our consumer duty measurement activity which not only allows us to have timely customer feedback but also that we are building an evidence stack for internal & external stakeholders”